Surprising weakness in the memory chip market in Q4 took the wind out of the sails of the global semiconductor market, causing growth in 2007 to fall short of expectations, according to iSuppli Corp.

Revenues of the global chip market grew by only 3.3 percent in 2007, based on the results from iSuppli’s final 2007 chip market share data. In a preliminary estimate released in November, iSuppli predicted the global chip market would grow by 4.1 percent in 2007.

DRAM revenue fell by 19.1 percent in Q4, down from Q3. This compares to iSuppli’s earlier forecast of a 4.7 percent decline. Meanwhile, NAND flash revenue declined by 3.9 percent in the same quarter, well below iSuppli’s previous forecast of 3 percent growth. This caused memory chip revenue in Q4 to decline by 11 percent sequentially, down from iSuppli’s prediction of 1.2 percent growth in overall memory chip revenue.

The previous growth estimates presented by iSuppli were heavily influenced by the Q4 revenue guidance presented by semiconductor suppliers in their communications with the investment community in October and November. This poor performance in the memory market was significantly below industry expectations for Q4.

"This was a complete role reversal for memory semiconductors compared to 2006," said Dale Ford, senior vice president, market intelligence, for iSuppli. "During the second half of 2006, memory IC revenues helped to prop up the growth of the overall semiconductor industry. In 2007, the poor results for memory chips restrained overall market growth. If memory were excluded from the revenue total, the semiconductor market would have grown by 2.4 percent in Q4. However, due to the influence of the weak memory market, total semiconductor market revenues fell by 0.5 percent in the fourth quarter."

Memory divergence

Weak market conditions had a major impact on most memory suppliers in 2007, including Nanya Technology and Qimonda, which saw their memory IC revenues fall by 32.4 percent and 26 percent, respectively, for the year.

Leading memory chip supplier, Samsung Electronics Co. Ltd, experienced a decline of 3.3 percent in its memory semiconductor revenue in 2007—contributing to a 0.8 percent decline in total chip revenue for the year.

However, there were some exceptions to the weak conditions in the memory segment. Hynix Semiconductor Inc., Toshiba Corp. and Elpida Memory Inc. achieved memory-chip revenue growth of 15, 14.5 and 8.8 percent respectively in 2007.

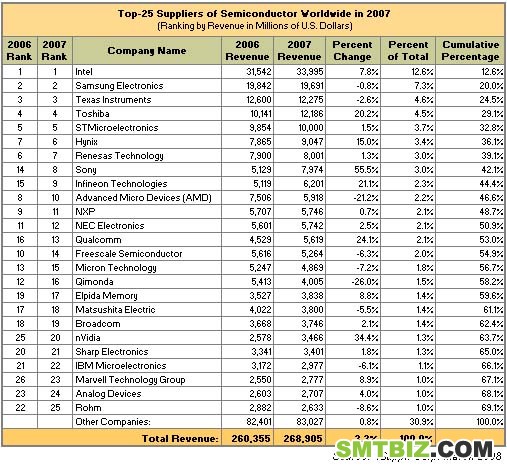

Table 1 presents iSuppli’s final rankings for the world’s Top 25 semiconductor suppliers in 2007.

Semiconductor standouts

Outside of the memory segment, several companies and product categories posted impressive performances. Infineon Technologies AG in 2007 jumped to the world’s No. 9 ranking among global semiconductor suppliers, up from 15th in 2006. During 2007, Infineon acquired Texas Instruments Inc.’s DSL Customer Premise Equipment (CPE) chip business and its wireless baseband semiconductor unit, adding a boost to its revenue. Infineon had fallen out of the Top 10 ranking in 2006 after it split out its memory unit to form Qimonda.

Infineon in 2007 returned to the Top 10 rankings with a revenue rise of 21.1 percent compared to 2006 due a combination of organic expansion and new revenues from its acquisitions. Sony Corp. achieved growth of 55.5 percent in 2007, propelling it to No. 8 in the global rankings, up from No. 14 in 2006. However, it must be noted that this growth was driven by business within Sony. Key to this growth was demand for chips for Sony’s own PlayStation 3 (PS3) video game console.

Suppli’s final rankings for the world’s Top 25 semiconductor suppliers in 2007.

Toshiba also benefited from supplying chips for the PS3 as well as its success in NAND flash memory. The Japan semiconductor firm attained the third highest revenue growth among the Top 10 suppliers in 2007, up 20.2 percent from 2006. This has positioned Toshiba to vie with Texas Instruments for the third rank in 2008.

Fabless is fabulous

Except Sony, it was two U.S. fabless semiconductor supplier—Qualcomm Inc. and nVidia Corp.—that led the growth among the Top 25 chip companies during 2007.

Qualcomm’s revenues grew by 24.1 percent as it moved up three positions in the rankings to reach 13th place. For the first time, a position in the Top 10 is within reach of a fabless semiconductor supplier. nVidia achieved revenue growth of 34.4 percent and leaped from No. 25 to No. 20 in the rankings. nVidia’s revenues also received an additional boost from its acquisition of PortalPlayer during 2007.

Big get bigger

Overall, the top 25 semiconductor suppliers significantly outperformed the combined performance of companies ranked lower than them in 2007. The Top 25 as a group achieved revenue growth of 4.5 percent in 2007 while the combined growth of all other semiconductor suppliers was only 0.8 percent.

Other notable developments in the 2007 semiconductor market included:

Logic application specific ICs (ASSPs and ASICs) enjoyed the strongest performance of all semiconductor segments with growth of 12.9 percent. Sony and Toshiba were the key drivers of growth in this segment due to their sales of semiconductors for the PS3. Among the Top 10 suppliers in this market, nVidia also achieved an outstanding year.

Other product categories that enjoyed above-average revenue growth in 2007 were optical semiconductors, with a 7.4 percent rise and sensors and actuators with a 7.3 percent expansion. Discrete semiconductors even managed growth of 4.2 percent.

In the microcomponent category, Intel Corp. enjoyed a return to healthy growth in its microprocessor revenue, with an 8 percent rise in 2007. This growth came at the expense of Advanced Micro Devices Inc., which saw a significant decline in its microprocessor revenues. Overall, microprocessor revenue grew by 2.1 percent in 2007.

Global revenue growth for analog ICs amounted to 2.9 percent in 2007. Among the Top 10 suppliers of analog ICs, Qualcomm and Infineon delivered notably strong revenue growth with increases of greater than 20 percent for the year.

Among applications for semiconductors, automotive electronics drove the highest growth opportunities in 2007 with 11.2 percent growth. Regionally, Asia Pacific accounted for the highest regional growth as it expanded by 6.6 percent in 2007.